This post is inspired by a

twitter conversation I participated in last month that started

when pseudonymous blogger/tweeter/super-valuation-expert Jesse Livermore posed

an interesting question:

At issue is whether stock earnings yields should be considered real or nominal.

[1] We all

know that with bonds we need to inflation-adjust the nominal yield to find the real yield. But do we need to do any sort of

inflation adjustment for earnings?

Jesse Livermore’s answer is no, and this seems to be the default

assumption. In an ideal world, accounting earnings would measure sustainable real economic income, and would not have to be adjusted for inflation. The common

practice of comparing earnings-based measures of valuation between eras with

very different inflation rates relies on the assumption that accounting earnings are real and

not nominal. (Note that the inflation adjustments used in calculating the

Shiller CAPE do not address the issues treated here.)

[2]

But I don't think inflation can ignored so easily; as I will explain, inflation can cause a “distortion” (for want of a

better term) in earnings measurement. Furthermore, I will explain how we can attempt

to approximately quantify this distortion, for a firm or for a market, using the following earnings

adjustment equation:

Inflation adjusted earnings

≈ reported earnings – inflation * book value of tangible equity (t-1)

The basic idea (as discussed in detail below) is quite

simple: the nominal value of items on a firm's balance sheet will tend to increase over time just to keep pace with inflation. This purely nominal increase will be

reflected as net income, due to the

clean-surplus nature of accounting. This

causes earnings to be overstated relative to a situation with no inflation.

The adjustment does not require that the book value

perfectly measure the true value of the firm. For example, assets are carried at historical cost. Still, if the firm has a relatively stable business model, such that the fraction of true firm value that appears on

the balance sheet is constant, then the balance sheet will tend to grow along

with inflation, resulting in a portion of reported net income that is purely nominal.

If we take the earnings adjustment equation and divide through by the

market value of equity, (and ignore the “t-1” lag), we get the yield adjustment

equation:

adjusted earnings yield ≈ reported yield

– inflation * tangible-book-to-market ratio

In the US market today, inflation is low, and most firms

(especially non-financial firms) have tangible-book-to-market ratios much closer

to zero than one, so the adjustment is fairly negligible. But this has not always been true in other times and places. In

the 1970s, inflation was above 5% and tangible book to market

ratios were well over 50%, implying that inflation could have a meaningful

distortionary effect on earnings yields. I suspect this may be an important factor

underlying the seemingly low valuations and slow earnings growth in the US

market in the 1970s and 1980s.

I will now walk through three highly simplified examples to

show how the inflation distortion occurs, then discuss some complicating factors and briefly discuss the

implications for valuation.

[3]

Example: All Cash

Start with the simplest possible example. A firm starts the

period with no liabilities, and only one asset: $100 in cold hard cash. Thus the firm also has $100

of shareholder equity, all of which is “tangible.” Assume the firm conducts some business during the period, resulting in $X in total sales, and

$X-10 in total cost of sales plus all other expenses. The income statement is:

Sales X

Cost

of Sales + Other Expenses X-10

Net Income 10

Accounting profit for the period

is $10. Assume no dividends, stock issues or buybacks, borrowing, or lending.

Then at the end of the year the firm again has only one asset, $110 in cash. Likewise shareholder equity has increased to $110, with a $10 increase in the retained earnings account balance.

Now assume we

are told that inflation over the period was 10%. Then the $110 cash the firm

has at the end of the period is worth exactly the same as the $100 in cash it

started with. The $10 gain was purely nominal, real gains were zero. There are

no economic profits.

Note that we do

not have to worry about the details of the business, how inflation affected

each individual transaction that went into X, or even how large X is. Instead

we can simply focus on the balance sheet. The principle of clean surplus

accounting tells us that net income over a period is equal to the change in the

value of shareholder's equity over the period, assuming for simplicity (and

without loss of generality) that there are no other transactions with

shareholders (i.e. no dividends or stock issues/buybacks.)

[4]

In this example, the increase in the value of equity and hence also net income, was a purely

nominal increase. If we use the earnings adjustment equation, we see that inflation-adjusted profits were zero:

0$ = $10 – 10% *

$100

Example: Inventories

Imagine a retailer that sells widgets. At the beginning of

the period they have an inventory of 100 widgets that they purchased wholesale

at $1/widget. Assume there are no other assets or liabilities, so the balance

sheet just shows $100 in inventories, balanced by $100 in equity. During the

period they sell all 100 widgets for $150 total, incurring $40 of expenses

along the way (wages, overhead, etc.). At the end of the period, they buy 100

new widgets to restock their inventory. Assume inflation is a uniform 10%, so

the new widgets cost $110. The income statement is:

Sales 150

Cost of Sales 100

Other Expenses 40

Net

Income 10

Observe that the firm is now in exactly the same economic

position as before, with 100 widgets and no cash. They have shown net income of

$10, and the inventory asset and retained earnings equity accounts on the balance sheet have

each increased by $10. But there is nothing left over to pay to shareholders,

and no real economic earnings.

Note that if inflation is uniform and affects all goods and

services at the same rate, the firm could go on like this forever, with each

line on the income statement and balance sheet growing at the rate of

inflation, showing positive earnings period after period, but never generating any real

increase in value or providing any payouts to shareholders.

The inflation adjustment equation

looks exactly like the adjustment in the previous example:

0$ = $10 – 10% * $100

An important assumption here is that the inventory is

carried on the books at replacement cost. Under US GAAP (but not IFRS), many firms instead use

LIFO (last-in-first-out) accounting for inventory. This creates a so-called

“LIFO reserve,” which makes current profits lower and more accurate in real terms,

but makes the balance sheet less accurate. This effectively pushes the inflation distortion

out into the future, creating artificially higher accounting earnings in the future periods when the LIFO reserve is eventually liquidated. This is an example of

how inflation in one period can distort earnings in subsequent periods (the

next example using capital goods will show another way this can happen.)

Nevertheless, even with LIFO accounting, if the firm (or market) is in a steady

state where the LIFO reserve is not growing as a percentage of firm value, the

earnings adjustment equation would still work.

Example: Capital

Goods

Now consider a firm that rents out trucks. Assume the only asset

is a fleet of trucks, and there are no liabilities. The firm operates in a

steady state, where every year the company buys exactly one new truck, and

disposes of its oldest truck. Furthermore assume that the trucks are carried on

the balance sheet at historical cost, depreciated straight-line over 5 years,

and that inflation has caused the price of trucks (and everything else) to

increase steadily for several years at a constant rate of 10%. At the beginning of the period the firm has

just purchased a new truck for $50,000. The asset and accumulated depreciation balances for the "fleet-of-trucks" asset would be derived as follows:

|

|

BOOK VALUE

|

|

Truck Age

|

Historical Cost

|

Begin Period

|

End

Period

|

Depreciation expense

|

4

|

34,151

|

6,830

|

-

|

6,830

|

3

|

37,566

|

15,026

|

7,513

|

7,513

|

2

|

41,322

|

24,793

|

16,529

|

8,264

|

1

|

45,455

|

36,364

|

27,273

|

9,091

|

0

|

50,000

|

50,000

|

40,000

|

10,000

|

Totals

|

`

|

133,013

|

91,315

|

41,699

|

Assume that the firm derives $100,000 in revenues from

renting out its trucks during the year, and incurs other cash expenses totaling

$45,000. Then the income statement is:

Sales 100,000

Depreciation Expense 41,699

Other Expenses 45,000

Net Income 13,301

At the end of the year, the firm has $55,000 in cash (sales minus cash expenses): just

enough to buy a new truck at the new 10% higher price! Thus the firm is once

again left in the same economic position as before it started, with the same

number of trucks of the same ages, and no cash. Once again there is no economic

profit, despite the reported net income of $13,301. Once again the inflation

adjustment is equal to the inflation rate multiplied by the book value of

equity at the beginning of the year.

0$

= $13,301 – 10% * $133,013

Note this does not depend on the depreciation schedule

accurately representing economic depreciation, and the truck asset does not

need to accurately measure the value of trucks. For example, the trucks may

last for more than 5 years.

But none of that matters for the inflation adjustment - all that matters is that

the “trucks” asset on the balance sheet has the same relation to true truck

value over time, implying that the “trucks” asset needs to grow at the rate of

inflation just to keep the real value of trucks constant.

Discussion

In the interest of simplicity, the previous examples assumed that

real profits were zero, and there were no payouts to shareholders. We could

easily modify the examples to relax these assumptions without changing the basic lesson.

I have focused on the balance sheet approach, because it seems

simpler. But we can also describe these distortions in terms of items on the

income statement. In the widgets example, the cost of sales is effectively

understated, because it uses the historical cost of widgets rather than the replacement

cost when the widget is sold. In the trucks example, the depreciation expense

is understated relative to the case of no inflation since the depreciation is

calculated based on percent of historical cost, rather than on current cost.

Liabilities

For simplicity, these examples have also ignored liabilities.

Liabilities on the balance sheet act much like cash in the first example,

except with the sign reversed. In a steady state, if the balance sheet is to

grow with inflation, liabilities will also grow, but this growth in nominal

liabilities makes reported earnings lower rather than higher. This is why the

inflation adjustment is based on equity (assets minus liabilities), rather than assets.

One issue I ignore here is the one-time gains or losses in financial assets and liabilities that will result when inflation shifts unexpectedly. Also

ignored is whether/how these gains or losses are marked-to-market on the

balance sheet. I suspect that these complications mostly have the effect of

shifting earnings between periods, rather than creating permanent distortions

in earnings.

Changing vs Stable Inflation

The examples above assumed that inflation was stable over time, which greatly simplifies the analysis. In particular, when the firm has multi-period capital investments, the distortionary effect of inflation on earnings in one period is not confined to that period, but will play out over several subsequent periods.

Consider again the trucks example. Imagine that instead of constant inflation, we had a one-time increase in prices, with no inflation in other years. After this burst of inflation, the "trucks" asset balance would continue to increase each year for a period of five years, until the historical cost of all of the trucks still on the balance sheet caught up to the new post-inflation price of trucks. Thus each year earnings would be overstated until the nominal value of the "trucks" asset reached a new steady state.

This shows that if inflation is volatile rather than constant, the adjustment becomes more complicated. To use the earnings adjustment equation, the current inflation rate would need to be replaced with some weighted average of current and past inflation.

Intangibles

Much of the value of a modern corporation arises from things that do not appear on the balance sheet. These “intangibles” include things such as brands, organizational capital, relationships with customers and suppliers, trade secrets, accumulated R&D, etc. The distortionary effect of inflation on earnings is driven entirely by growth in assets that are recorded on the balance sheet, because their nominal balance sheet value must grow over time to keep up with inflation (as described in the examples above). Although intangibles usually require investments to maintain their value, these investments are generally expensed immediately, and thus do not show up on the balance sheet at all. Hence off-balance sheet assets, such as many intangibles, will be irrelevant for the inflation adjustment.

There is a subset of intangibles, however, that do appear on balance

sheets (the majority of which is goodwill). As with other intangibles, any

investments needed to maintain theses assets will not show up on the

balance sheet. Thus my assumption is

that on-balance-sheet intangibles do not need to grow in order to keep up with inflation. This

is why the adjustment equation uses tangible book value rather than total book

value.

Note that even though intangibles may reflect a failure of

accounting to fully reflect the value of the firm, this does not invalidate the

inflation adjustment equation. It is still the case that the tangible equity

portion of the balance sheet will tend to grow to keep up with inflation.

Relative Prices

A big assumption in this analysis has been that inflation is

uniform across all goods. This is, of course, not true in the real world. In

particular the cost of manufactured goods has generally fallen relative to

other goods and services, and this has surely had some effect on firm balance

sheets. This raises the issue of which inflation measure to use,

and more generally how to account for relative price changes. I will explain why we should use the overall inflation rate, rather than the price change that applies to the particular assets of the firm.

In a competitive market, anticipated changes in

relative prices should not affect the real return on investment. For example, imagine the nominal price of trucks stays constant while overall prices rise. Because of competition, you would expect that this fall in relative price would be passed on to consumers in lower rental fees, such that the real effective return on investment remained constant. The lower relative price of trucks indicates they are actually worth less in real economic terms, and that the firm is likewise less valuable. The lower real value of the "trucks" asset would represent a real economic loss, but this loss is not reflected in accounting income.

In the real world, things might be a somewhat more complicated. First, changes in relative prices that are not anticipated might be expected to change the return on sunk investments, at least in the short term. But this effect can go either direction and should tend to cancel out over time.

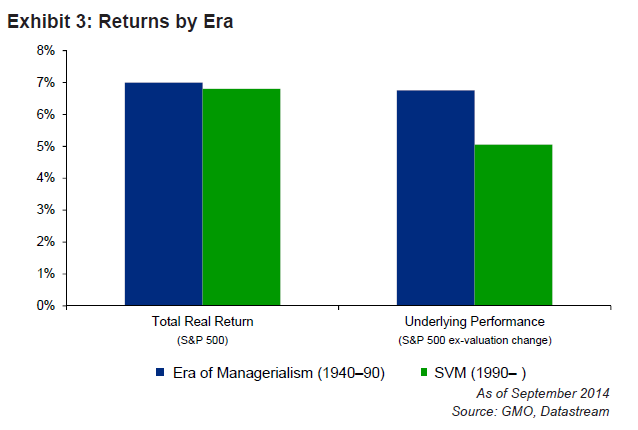

Over the longer term, the fall in the relative price of manufactured goods would lead to an increase in the value of intangibles relative to tangibles. In fact the US market has seen a very strong trend in this direction, measured in terms of the

share of market value that is captured by tangible book value (see figure 1). (The

decline in the relative price of manufactured goods are likely just one factor underlying

this trend. Other factors could include changes in technology, industry mix,

accounting rules, etc.).

Figure 1

This is a really striking trend that might well have

important implications for earnings measurement, and whether/how earnings

yields can be compared across time. It probably merits more attention than I

can give it here.

On the other hand, the factors causing this shift, including

changes in relative prices, have been evolving for decades, and there is no

particular reason to believe the trends were any stronger in the high-inflation

1970s than the low-inflation 1990s. The inflation adjustment discussed here

should be taken as an adjustment for the overall inflation that is orthogonal

to changes in relative prices.

Other Accounting Distortions

The inflation adjustment here does not require that book value perfectly measure the value of the firm. Likewise, it does not require that accounting earnings perfectly measure economic earnings, if the purpose is to compare valuations over different times or places. For example, perhaps you believe that (for some reason) accounting earnings in the US market consistently overstate true economic earnings. The analysis here merely suggests that they were

even more overstated in high inflation periods than in low inflation periods, and that this should be taken into account when doing comparisons.

A similar argument can be made for changes in distortions. There may be reasons to believe that accounting earnings today need to be

adjusted for reasons other than inflation in order to make them comparable to earnings in the past. The inflation adjustment discussed here is simply in addition to any other such adjustments.

Implications for valuations

In the US market today, inflation is below 2% and the

tangible-book-to-market ratio is below 20% (see figure 1). Therefore the inflation adjustment for the earnings yield will be small, perhaps on the order of 25 basis points.

However, the situation was very different in past decades. In the 1970s, general

inflation averaged over 5%, and the aggregate tangible-book-to-market ratio was something

like 80%. Therefore the yield adjustment equation would suggest we should

adjust earnings yields in the 1970s down by as much as 4 percentage points in order to make them

comparable to current yields. This would correspond to a shift in the P/E ratio from 10

all the way up to 16.7. I would not be surprised if this is an important factor

explaining both the low valuations and slow real earnings growth in the US market in

the 1970s and early 1980s.

I don’t know much about emerging markets, but it would

not surprise me if inflation might cause earnings yields to be misleading there as well.

Proceed with caution.

Comments welcome.

[1]

The earnings yield is the reciprocal of the price earnings ratio. We should

expect a relationship between the real earnings yield and the long run rate of

return, as explained in this

wonderful note from Brad DeLong.

[2] To calculate CAPE (Cyclically Adjusted PE ratio), Shiller adjusts the

price and earnings series to constant dollars, in order to allow combining

earnings from different years to create a moving average used to smooth the earnings

series. However this does not correct for any bias created in earnings

measurement within a single period, which is the issue addressed here.

[3]

The basic ideas here are not new. They were well known in earlier high inflation decades, but seem to have been mostly forgotten. However the simple earnings adjustment equations and the application to understanding historical valuations are not something I've seen before.

[4]

Clean surplus accounting means that all changes in shareholder equity

that do not result from transactions with shareholders (such as dividends,

share repurchases or share offerings) are reflected in the income statement.”

(See the link below). There are a few items for which clean surplus accounting does not

apply, “most notably foreign currency translation adjustments and certain

pension liability adjustments,” which are not included in net income, but

instead are reported as part of “comprehensive income.” This are probably not

too important for this analysis, and I will be ignore them.

http://financial-education.com/2007/08/11/clean-surplus-accounting/